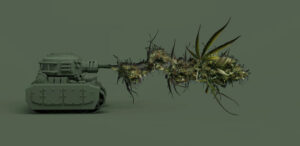

Nova Cannabis (Value Buds) and High Tide (Canna Cabanna) have been waging a war for the biggest market share of Alberta Cannabis.

Are they waging this war with quality? With amazing customer service? With educating the consumer?

Unfortunately no. These are not on the forefront of their business strategies.

With Value Buds posting little to know profit working under their bargain brand. (The gross margin as a percent of sales from retail sales remained relatively flat compared to the same period in the prior year as a result of converting most locations to the Value Buds discount banner in Q2 2021 compared to the former “Nova Cannabis”, “YSS” and “Sweet Tree” banners which operated under a different operating, pricing, and margin strategy.)

As well as Canna Cabana boasting they are the “Costco of Cannabis” (Canna Cabana locations, modelled after Costco’s membership-based program. Some have even deemed the company the “Costco of Cannabis).

We can see very clearly that it’s a battle for the bottom. Which company can sell the cheapest weed? Which company can sell themselves the longest to win it all?

Now, in the short term, as the consumer, “Great News” right?

And you are right, for now.

Once either of these two gain the monopoly we are going to see a sharp increase in price, with no incentive to improve the quality. They are going to have to make back the money for the investors somehow. Leaving us to fit the bill.

It’s also happening a lot faster than you think.

“We see significant market share in the province of Alberta where Value Buds has captured 21.5% of market share with a 58-store footprint, ” Marci Kiziac – CEO – Nova Cannabis

Though High Tide’s financials are much harder to come by, “Due to personnel challenges arising from the pandemic, the Company has not been able to finalize its income tax provision to date, we can still see that their business strategy is much more focused on quantity over quality.

At a glance, With these two large corporations swallowing up as much of the market as they can take, by pursuing the cheapest weed money can buy; seems to me akin to two crack whores competing on the same corner.

So, when we are only left with $5 handies from some nameless, toothless hooker, who won’t even look us in the eye, we have nobody to blame but ourselves.

- (https://www.newswire.ca/news-releases/high-tide-announces-unaudited-2021-financial-results-featuring-a-118-increase-in-revenue-and-record-adjusted-ebitda-of-12-4-million-817139536.html )

- Net loss and comprehensive loss. For the three months ended September 30, 2022, the Company recorded a net loss of $1.5 million compared to a $6.2 million loss in the third quarter of 2021 and $1.4 million loss in the second quarter of 2022. The reduction in loss compared to Q3 2022 is primarily a result of the increase in sales and gross margin for the three months ended September 30, 2022. The increase in net loss from Q2 2022 related to changes in certain non-cash fair value adjustments recognized in the prior quarter. – (https://www.newswire.ca/news-releases/nova-announces-third-quarter-2022-results-876492603.html)

- How High Tide Became the ‘Costco of Cannabis’ High Tide has become known for its discount club retail model at its Canna Cabana locations, modeled after Costco’s membership-based program. Some have even deemed the company the “Costco of Cannabis.”- (https://www.cannabisbusinesstimes.com/article/how-high-tide-became-the-costco-of-cannabis-canna-cabana/ )

- The company is a lead player in the Canadian cannabis retail market through its flagship retail brand, Canna Cabana—which has 141 locations across Ontario, Alberta, British Columbia, Manitoba and Saskatchewan. High Tide also serves the U.S. and Europe through consumption accessories and CBD-focused e-commerce platforms. – (https://www.cannabisbusinesstimes.com/article/how-high-tide-became-the-costco-of-cannabis-canna-cabana/)

- Alberta Gaming, Liquor & Cannabis has listed 967 licensed retail sites and includes provincial retail chain affiliates. – (https://www.respectmyregion.com/cannabis-retail-stores-canada/)

- Sales increased 52.4% compared to the third quarter of 2021, to $58.9 million from $38.7 million. The increase is primarily due to the 29 retail cannabis stores that were opened since June 30, 2021, and increased sales from stores that were re-branded to the Value Buds discount banner from “Nova Cannabis,” “YSS,” and “Sweet Tree” at various times throughout 2021 – (https://www.newswire.ca/news-releases/nova-announces-third-quarter-2022-results-876492603.html)

- The gross margin as a percent of sales from retail sales remained relatively flat compared to the same period in the prior year as a result of converting most locations to the Value Buds discount banner in Q2 2021 compared to the former “Nova Cannabis”, “YSS” and “Sweet Tree” banners which operated under a different operating, pricing, and margin strategy. During the current year, the Company revised prices at certain retail locations where the competitive response has waned which contributed to the increase in gross margin percentage. – (https://www.newswire.ca/news-releases/nova-announces-third-quarter-2022-results-876492603.html)